PR support in strategic investor relations at retail companies

Valery V. Bezpalov*, Anna B. Tsvetkova, Marina G. Shilina, Vera V. Golovina, Svetlana A. Avtonomova

Plekhanov Russian University of Economics, Russia, 117997, Moscow, Stremyanny Lane, 36.

Correspondence: Valery V. Bezpalov, Stremyanny Lane, 36, Moscow, 117997, Russia; Email: valerib1@ yandex.ru

|

ABSTRACT As a research subject, the relevance of PR support in retailers' strategic investor relations is due to the fact that for a long time now, following the financial crisis and in the wake of geopolitical tensions, companies in the retail sector in Russia have withheld stock offerings, particularly among foreign investors. Thus, information and communications support are necessary to reach out to investors and provide them with all crucial information not only about the company but also the industry and outlook. Greater relevance is now found in comprehensive efforts to maintain all communication processes in preparation for an IPO, which might promise more efficient performance in building awareness among the investment community concerning the company's investment advantages, development goals, financial standing, and social focus. Keywords: communications activities, PR support, retail, social orientation, strategic approach, strategic investors |

Introduction

Purpose

PR support in strategic investor relations (IR) is a relatively under-researched subject. Most studies in the area are primarily concerned with either setting up PR support efforts in general or with the IR field. The specific subject of this study is at the intersection of the above fields and is also related to such direction as financial PR.

Literature Review

The scholarly issue of PR and PR support has been addressed in multiple papers. The theoretical aspects are outlined in research papers concerned with the development of commercial networks of the consumer market. [1, 2] The methodological foundations of private label management in retail chains are described in the dissertation. [3] Besides, the developmental patterns of PR activities are studied both in general [4, 5] and specifically through the lens of reputation capital development. [6, 7]

The aspects of development in retail companies and specifics of their PR support in the rapidly changing market environment are discussed in the paper. [8] A major contributor to the analysis of trends in the sector is the Deloitte international network. [9, 10] The relevant applied problems of developing PR support tools and applying techniques and methods of advertising and PR in retail companies are described in various analytical reports available online. [11-13] The developmental aspects of the sector of children's goods are laid out at the website of the Detsky Mir PJSC [14, 15] and in media publications regarding the company's IPO.

Following an analysis of earlier papers on PR support of strategic IR at retail companies, the conclusion is that the set objectives should be further refined in terms of efficient application of marketing tools, planning promotional and PR activities, reputation capital development, and reputation support efforts in strategic IR, which lends relevance to the subject of this study.

Introduction

A key highlight today should be the role and importance of establishing efficient IR for a public company not just ahead of an IPO, but in subsequent operation as well. It is indispensable in maintaining fair market valuations of the company's stocks and ensuring timely crisis response and efficient management of the company's reputation, public image, and constant media presence, as required to build a positive company profile among potential investors [16]. This requires arranging PR support for IR involving both traditional PR tools and various techniques and activities around financial and IR communications, which implies certain specifics of PR support in the area. The novelty and practical significance of this paper consist in the fact that it represents a study of PR support arranged by Detsky Mir in preparation for the IPO, with a focus on specific advantages and drawbacks of the process and a proposal of a forward-looking strategy and a program of PR support in IR for 2020.

Methods

Notably, special literature offers relatively few interpretations of the concept of PR support and even experts often take on contradictory approaches. Arguably, there are two comprehensive definitions of the concept of PR support. On the one hand, it refers to "the management techniques of a subject in PR communications with its target audiences, characterized as a set of systematically applied procedures, approaches, and methods targeting the most optimal and efficient performance on the goals and objectives of the management subject within the set time and place". [5] In this case, PR support is comparable to communication management. On the other hand, it refers to a "complex of integrated activities to develop the company's positive image and raise its recognition profile through the maximum extension of its media presence using PR tools and methods". [4] Here too, PR support corresponds with recognition and public image development through the implementation of PR activities to ensure the company's media presence. However, in our view, this definition limits the scope of PR support, though it does emphasize the importance of efforts to ensure the company's media presence, which forms its open and transparent profile. In fact, given the above definitions, the functions of PR support in IR consist in maintaining the company's comprehensive media presence and ensuring its open and transparent profile through information flow management and spreading financial and other information via diverse channels catering to both the investment community and other important target groups, which highlights the importance of this process for efficient company operation.

PR support in strategic IR around an IPO is understood to represent a strategic process involving the application of various methods comprising certain types of communication techniques and activities. In general, the strategic approach to PR support in IR comprises the following techniques: the method of a comprehensive analysis of the existing communications outlook; the method of communication audit; the method of information support and traditional IPO-related activities engaging analysts and investors; the method of developing an IR system to maintain IR in the future as a public company.

Results

Deloitte, the accounting company, conducts annual global analyses comprising public companies in the retail segment. The report pinned the total turnover of the 250 biggest public retail companies in the fiscal year 2018 at 4.53 trillion USD, up 5.7% from the previous year. The market grew by 3.3% in five years. Overall, the average annual turnover per public retailer equals 18.1 billion USD. However, regional differences are observed across the global market in the retail development profile. For example, the biggest growth is registered in developing markets, primarily, the Chinese retail market, which is home to Alibaba, one of the biggest online retailers. As of the fiscal year 2018, the Chinese retail market grew by 10% and further growth is expected with the active development of the middle class. Turnover growth, though less intense, is also projected for other developing markets, such as India and Brazil. [10] The US market shows moderate growth (3.5%) with the rising influence of Amazon, which, combined with the outpacing price trends compared to income growth, results in closures or lost sales for many retailers. [10] That said, the top four spots among the biggest 250 public retailers are held by US companies.

The European retail market has stabilized after significant growth in the past years. The main dangers for EU retail market development include intensifying separatist sentiments and economic nationalism, as indicated by a decline in the UK market following Brexit announcements. Thus, European retailers are most likely to operate in the international market. [8] Besides, European retailers make the largest group among the 250 biggest public retail companies: there are 87 European companies (34.8%) commanding a share of 33.8% in the total turnover. [9]

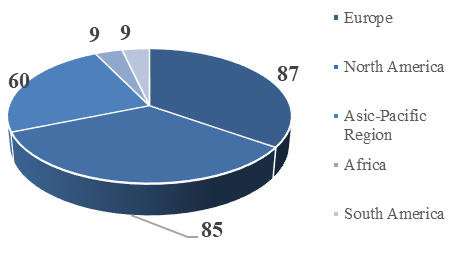

The Russian retail market is in a gradual recovery after the crisis: it grew by 3% in 2017 due to the moderate price stabilization and continued regional expansion of large retail chains. The deterrents are declining real incomes and the unstable exchange rate of the ruble. A notable trend in the Russian retail market is that the food segment is dominated by national chains, while international chains prevail in the non-food segment. [11] Thus, the retail industry across countries and regions is primarily influenced by political and economic factors, but the market's globalization profile is rising as well. With that, the numbers of major public retail companies show the uneven distribution across various regions, as can be seen in Figure 1.

Figure 1. Number of major public companies in the retail sector by the regions globally [1]

The world's ten biggest retailers are largely oriented at the international market. Meanwhile, the fast-moving consumer goods segment (FMCG) has become the biggest one in the retail sector. Just over half of the 250 companies, 138, operate in this segment but account for 66.2% of the total revenue. The non-food sector is represented by 50 companies contributing 18% of the turnover. A slightly smaller number of companies operate in clothes and accessories and the rarest type is general merchandise retailers (Table 1).

In Russia, the most comprehensive PR support strategy in the retail industry is arguably run by X5 Retail Group, operating with a special-purpose IR Department and a website for investors providing daily updates on corporate news, full coverage of financial data, reports, and presentations. Moreover, events of all kinds are frequently held to facilitate IR.

|

Table 1. The product structure of the biggest public companies in the retail industry [1] |

||

|

Products |

Number of companies |

Share of the turnover |

|

Food |

138 |

66.2% |

|

Non-food items |

50 |

18.0% |

|

Clothes and accessories |

40 |

9.8% |

|

General merchandise |

22 |

6.0% |

Similarly to the global market, the Russian retail sector also shows a trend toward consolidation and the rising influence of major retail chains. As of the end of 2018, retail chains on average accounted for 32.6% of the total retail turnover, with an even higher figure for the food segment (38.5%), both levels indicate a growth of 3% vs. the previous year. [13] Remarkably, the market is growing primarily in natural terms, rather than monetary terms, as retailers respond to declining purchasing power and expand special promo offers and discounts resulting in bigger sales but lower margins in the segment. [11] In general, there is a significant increase in e-commerce (by 13% in 2018 compared to 2017) both on the part of exclusively online stores, such as Ozon and Wildberries and among retail companies expanding into online sales. Another growing segment is marketplaces aggregating multiple offerings from various retailers.

The biggest 250 global retail companies include four from Russia, all in the food segment: X5 Retail Group (chains Pyaterochka Karusel, Perekrestok) – 47th place; PJSC Magnit (chain Magnit) – 51st place; Lenta Group (chain Lenta) – 157th place; OJSC Dixy Group (chain Dixy) – 201st place.

All four companies are among the top 50 in the global retail league by the growth rate, led by Lenta Group, which expands sales by adding new stores. X5 Retail Group comes second and its growth is also spurred by acquisitions (Sedmoy Kontinent, Monetka). However, if the top 100 biggest Russian public companies are considered in general, only six companies from the retail sector will be present in this list (including M.video and Detsky Mir alongside the four companies mentioned above). Such a number is considerably behind those of the mining and manufacturing industries, which reflects the specifics of the Russian economic orientation. [12] In general, competition in the retail sector in Russia occurs in commerce to win market share but it is significantly weaker in IR as public companies are rare in the Russian retail sector and are primarily operating in the food sector.

The main environmental factors influencing retailers' PR support strategies in strategic IR include the following:

- most Russian retailers operate exclusively in the Russian market (and some CIS countries), so they are not well-known by foreign investors, which considerably complicates PR support;

- there are trust issues for foreign investors concerning Russian companies, as concerns prevail about corruption and state support, so on the way to an IPO, companies have to demonstrate attractiveness not only as they are but as an industry as well;

- the observed trends in the retail market as a result of slower growth and negative investment experiences in e-commerce drag down the investment attractiveness of the sector, so communications efforts should be focused on the retailer's development potential.

- competition for investors is rather weak in the sector given the relatively small number of public companies.

Quite often, Russian projects leave investors skeptical as few companies from this sector are present in the stock exchange and the Russian retail sector is relatively unknown for investors. Thus, PR support should involve intensified information efforts both in the media and via direct communications, as well as through analytical reports and information memoranda.

The brand Detsky Mir commands the top spot in terms of recognition in Russia. As of the beginning of 2019, it counted 673 stores across 252 cities in Russia and Kazakhstan. [15] Stores are primarily located at shopping malls and are often anchor tenants. That said, only in 2018, the company opened 100 new stores and plans to expand the chain further. In 2018, Detsky Mir stores counted more than 220 million visitors. Besides, in 2011, the company launched its online store.

The Detsky Mir Group is the leader of the children's retail segment in Russia with a market share of 23%. Its close competitors are the Korablik and Dochki-Synochki chains. However, the company shows much higher growth rates. In 2018, its revenue equaled 110.9 billion rubles, which is 14.3% higher than in 2017. Meanwhile, revenues of the online store had grown by 89.2% by 2017 to 8.8 billion rubles. [15]

Notably, the company also focused on its social image and reputation via media outreach. For example, the following articles appeared on the corporate website (and in some media titles, as well): "Detsky Mir I P&G okazali pomoshch domam malyutki" [Detsky Mir and P&G Offer Help to Baby Orphanages], "Detsky Mir peredal 740 tys. novogodnikh podarkov detyam s trudnoi sudboi" [Detsky Mir Transfers 740 Thousand New Year Gifts to Underprivileged Children], "Detsky mir otkryl 79 igrovykh komnat v 2016 godu" [Detsky Mir Opens 79 Activity Rooms in 2016], "Detsky mir nachinaet Detsky "KVN" [Detsky Mir Launches the Children's KVN], "Detsky mir vzyal pod opeku 200 tys. detei s trudnoi sudboi" [Detsky Mir Takes Guardianship of 200 Thousand Underprivileged Children]. That is indicative of active PR support in terms of media engagement and growth of the company's media presence. Press releases sent to potential investors were followed by an analytical report with a list of all contact persons to handle questions. Notably, the company handles PR support in IR on its own, with a dedicated in-house department established within the corporate structure. In general, the IPO of Detsky Mir was arguably successful, with the help of PR support involved, too. However, the point is, following the IPO, the company's IR system is not fully shaped: updates for investors are not frequent and, judging by the investor calendar, no events are held beyond the statutory agenda. Reports followed in 2018 that the company planned an SPO, but it has not been conducted yet. In general, the main advantages of PR support in IR in preparation for the IPO of Detsky Mir are, first of all, full conformity with the principles of information coverage of such events, active media engagement with considerable growth in publications about the company, not only focused on financial or investment topics but also shaping the company's social image and reputation. Another meaningful aspect is good competence in investor engagement, which led to fair market pricing of the company's stocks. Although there is no information about a roadshow, the company engaged in consultative work with investors.

The drawbacks include insufficient industry information alongside company news and the absence of a roadshow or corresponding information support. The main drawback is the lower IR profile following the IPO, despite the considerations of an SPO in the future.

Discussion

With its investment and reputation profile, Detsky Mir has a good basis for building an efficient PR support strategy in strategic IR. A key factor of investment attractiveness and an important element of PR support in IR for Detsky Mir is its reputation of a market leader in the children's product segment. In this market, public image and reputation play an important role in how a company is perceived by consumers, which directly influences its economic efficiency.

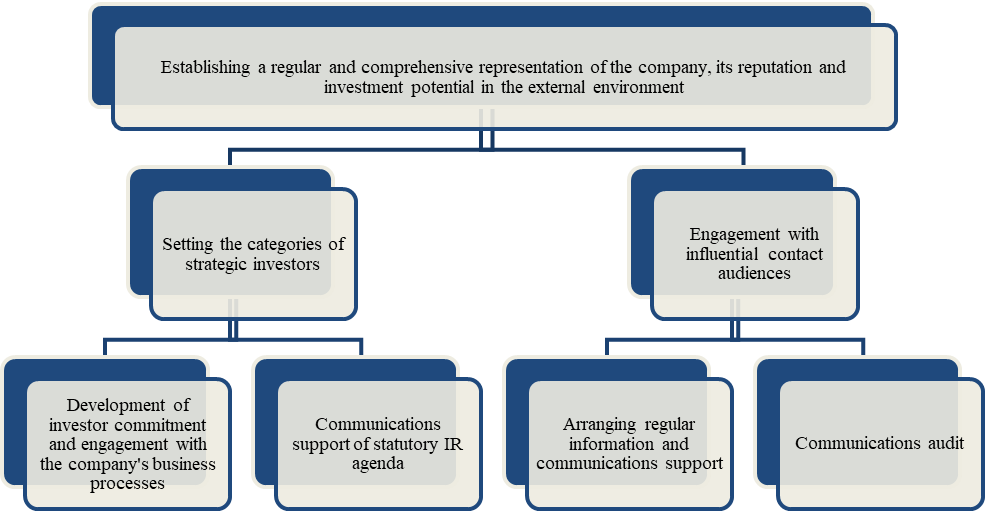

Many people acquire children's products only in reliable retail chains with a reputation in the market. Reputational loss can negatively affect the company's financial performance, as it directly influences consumer traffic at Detsky Mir stores. Due to this, to maintain investment attractiveness, PR support should also address business reputation and attractive public image of the company not only among investors but also among other contact audiences. In general, a key direction to improve the efficiency of PR support strategy development at Detsky Mir in strategic IR relates to establishing a regular and comprehensive representation of the company, its reputation and investment potential in the external environment to retain investor interest and focus and to support valuations of the company's stock at adequate levels (at least 85 rubles per share).

For that, the following PR strategy directions should be implemented:

- setting the category of strategic investors as a target for the main PR activities. Investor category identification should be guided by either major shareholding, a certain degree of market influence, authority, or interest in retail investments;

- developing investor commitment and engagement with the company's business processes, arranging regular information efforts and interactions;

- arranging regular information and communications support for company operations in the external environment, engagement with all contact audiences influencing company perceptions among investors (analysts, investment banks, media, public authorities, consumers);

- communications support of statutory IR agenda: conference calls, annual and quarterly reports, annual shareholders meeting, etc.;

- regular communications audit of the information sphere to monitor publications about the company, timely address negativity and improve the efficiency of communications.

Consider the following graphical visualizations of major directions of Detsky Mir's PR strategy in strategic IR (Figure 2). The implementation of the above directions would help to improve the efficiency of Detsky Mir's PR strategy in strategic IR.

Once the main directions to improve the efficiency of Detsky Mir's PR support strategy are identified, the next step is to chart the key principles to guide PR support efforts and to develop specific activities in the PR support program.

Figure 2. Directions of Detsky Mir's PR support strategy in strategic IR [developed by the authors]

The forward-looking strategy will focus on regular interactions with investors and on building a comprehensive representation of the company, its reputation, and investment potential in the external environment to establish an IR system and preparation of the information space and investors for a potential SPO in the coming years.

The strategy will involve the following key dimensions of PR support in IR:

- further development of investment history and potential of Detsky Mir;

- management of the company's news and communications flows through media engagement and operation of own information channels: website, social media;

- development, modification, and distribution of statutory IR materials using the most efficient communications methods;

- development of investor engagement methods and monitoring investor sentiments;

- extension of the potential and existing investor base.

The forward-looking PR support strategy in IR will involve the development of all directions of activities and application of PR tools. It will be guided by the understanding of investor expectations, sentiments, and concerns, as well as prompt response to potential negative changes in the internal and external environment influencing investor sentiments and, subsequently, market valuations of the company's stocks.

The implementation of the PR support program in strategic IR by Detsky Mir will be the responsibility of the company's PR department in cooperation with the IR department. Planned period of implementation: January-December 2020.

Stage 1. Analysis. At the first stage of the PR support program in Detsky Mir's strategic IR, feedback is collected from existing and potential investors and other contact audiences. Another efficient approach would be surveys of investors following stock sales to discover reasons for such divestment. The comprehensive analysis would be helpful to establish the overall sentiment in the market concerning Detsky Mir, appraise its existing reputation profile and public image affecting its investment attractiveness, and chart ways to consolidate positive perceptions of the company's image and reputation.

Stage 2. Establishing strategic investor groups. The second stage in the development of the PR support program in Detsky Mir's strategic IR should involve determining key investors, which we designate as improvement directions. Following the IPO, 86% of the sold stocks were acquired by foreign investors. [14] Most investors represent the UK, EU countries and the US, with an especially high share of investors from the UK that is why it is important to arrange communications through the British press and facilitate managers' trips to the UK to engage local investors there. Moreover, analysts at the company need to determine the most influential investors shaping the attitudes of the professional community to channel the efforts of PR support toward them.

Stage 3. Work with presentation materials. The third stage should involve the development of new or refinement and modification of existing presentation materials and methods of IR. We believe that the website for investors needs to be refined. Further, presentation materials should be reworked with a view to the findings of this analysis concerning investor concerns involved in decision-making concerning the acquisition of Detsky Mir's stocks and also positive factors.

Stage 4. Direct communications with strategic investors. At the fourth stage, Detsky Mir should establish direct target communications with identified strategic investors, handled by the company management, which would emphasize the importance of investors, project professionalism, and business reputation of the management as parameters of investment attractiveness of Detsky Mir. At this stage, presentations are developed in the PR support program to introduce company management; investor meetings are appointed; communications and information support is arranged in the media.

Direct communications with investors will also involve investor activities with wide geographic representation and combined business and entertainment profiles. The business section will feature annual fiscal results and a presentation of the company's outlook. The entertainment program will include a tour of Moscow, the first historical Detsky Mir store, and a presentation of the company's social efforts.

All stages of the PR support program in strategic partner relations will involve communications support in the media, including:

- priority media pool development (Russian, British, European, American);

- sending press releases to the media at least twice a week covering company news across a range of topics: company performance, social efforts, new unusual highlights in children's range, advertising, and PR campaigns, partner projects, investment news;

- the quarterly release of financial results as a summary of quarterly reports;

- press conferences on key corporate milestones for the year.

Thus, Detsky Mir will be able to arrange a consistent presence in the information space and build its reputation, public image and recognition, which will positively affect its investment attractiveness.

Conclusions

Major challenges and difficulties in the arrangement of PR support in strategic IR arise from the complexity of information flow management, the need to comply with various communications principles across the stages of the IPO preparation process, and the need to account for potential competitive moves and reputation crises. However, the advantages and potential of PR support in corporate IR relate to the possibility to expand access to funding, achieve fair market valuations on the company's stock, and mitigate negative effects from price fluctuations. PR support in IR during the preparation for an IPO takes place at each stage of the process; the objective is to create maximum reach and inform the investor audience about the company and its IPO plans, maximizing investor demand and achieving maximum offering price. Further support of IR and maintained media presence after the company goes public is of strategic importance, too.

References

- Dzreyan AKh. Sovremennaya transformatsiya tsepei postavok torgovykh setei potrebitelskogo rynka regiona: na primere Rostovskoi oblasti [Modern supply chain transformation in the regional consumer market as exemplified by the Rostov region]. Ph.D. thesis. Rostov-on-Don; 2013.

- Khizhina AM. Metody razrabotki i realizatsii strategii tsenovogo pozitsionirovaniya produktovogo portfelya zarubezhnoi kompanii na rossiiskom rynke [Development and implementation methods of price-based positioning strategy for an international company in the Russian market]. Ph.D. thesis. Мoscow; 2015.

- Starov SA. Metodologiya upravleniya sobstvennymi torgovymi markami roznichnykh setei [Methodology of private label management in retail chains]. Ph.D. thesis. Saint-Petersburg; 201

- Vorobeva TA. PR-soprovozhdenie: ponyatie i kontseptsiya [PR support: notion and concept]. Nauchnye vedomosti Belgorodskogo gosudarstvennogo universiteta. Series: Humanities. 2014; 24(26): 76.

- Kuznetsov VF. Svyazi s obshchestvennostyu: teoriya i tekhnologii [Public relations: theory and techniques]. Moscow: Aspekt Press; 2013, 197-198.

- Kuznetsov VF. Reputatsionnyi kapital: teoriya i praktika PR-deyatelnosti [Reputation capital: theory and practice of PR activities]: textbook for students of HEIs. Moscow: Vega-Info; 2008.

- Vahdani M, Farhadi Z, Mohammadi Mehr J. Investigating the Effect of Financial and Economic Development on Cost of Equity Capital. World Journal of Environmental Biosciences. 2019; 4(2):61-76.

- Bostoganashvili ER. Mirovoi I rossiiskii rynki roznichnoi torgovli v usloviyakh tsifrovoi ekonomiki [Global and Russian retail market in the digital economy]. Economics: Yesterday, Today and Tomorrow. 2018; 8: 1571.

- Global Powers of Retailing 201 [homepage on the Internet]. Deloitte; [updated 2019; cited 2020 Jan 30]. Available from: https://www2.deloitte.com/ru/ru/pages/consumer-business/articles/global-powers-of-retailing.html

- Global Powers of Retailing. Deloitte [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: https://www2.deloitte.com/content/dam/Deloitte/at/Documents/financial-services/at-deloitte-report-GPR2019.pdf

- Obzor i prognoz dlya rynka roznichnoi torgovli Rossii v 2018-2019 [Overview and forecast for the Russian retail market in 2018-2019] [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: https://promdevelop.ru/obzor-rynka-roznichnoj-torgovli-v-2018-2019-v-rossii/

- Reiting samykh dorogikh publichnye rossiiskikh kompanii – 2019 [2019 ranking of Russian most expensive public companies] [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: http://www.riarating.ru/infografika/20190129/630115992.html

- Rossiiskii riteil v 2018 godu: idealnyi shtorm s pereryvom na ChM-2018 Russian retail sector in 2018: A perfect storm with a pause for the World Cup 2018] [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: https://www.retail-loyalty.org/news/rossiyskiy-riteyl-v-2018-godu-idealnyy-shtorm-s-pereryvom-na-chm-2018/

- Detsky Mir PJSC. Annual report 2018 [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: http://corp.detmir.ru/u/section_file/5605/annual-report-2018-russian.pdf

- Detsky Mir PJSC. About Company [homepage on the Internet]. [updated 2019; cited 2020 Jan 30]. Available from: http://corp.detmir.ru/about/about_us/?_ga=2.184038374.1712102071.1558283571-1619339865.1558283571

- Ahmad F, Shahid Mn, Ateeq A, Zubair A, Nazir S. Emerging Markets Efficient or Adaptive? Evidence from Asia. Journal of Organizational Behavior Research. 2018;3(2):33-44.

Contact SPER Publications

SPER Publications and

Solutions Pvt. Ltd.

HD - 236,

Near The Shri Ram Millenium School,

Sector 135,

Noida-Greater Noida Expressway,

Noida-201301 [Delhi-NCR] India