Analysis of the Ukrainian market of medicines for gastrointestinal disorders treatment

Olha V. Buriak1, Ievgenii V. Gladukh1*, Maryna V. Podgaina2, Volodymyr V. Rudenko3

1Department of Technologies of Pharmaceutical Preparations, National Pharmaceutical University, Kharkov, Ukraine, 2Department of Organization and Economics of Pharmacy, National University of Pharmacy, Kharkov, Ukraine, 3Department of Military Pharmacy, Ukrainian Military Medical Academy, Kyiv, Ukraine.

ABSTRACT

Marketing research of medicinal products of the Silicone group (ATC code - A03A X13) for the treatment of gastrointestinal tract diseases has been carried out. Based on the results of the analysis of the pharmaceutical market, a sufficient number of registered drugs have been determined, among which drugs of Ukrainian origin insignificantly dominate. It has been established that 100% of registered silicone drugs are represented in the wholesale market. Structural analysis of dosage forms has shown a significant dominance of silicones in the form of oral drops (33% among 5 dosage forms of silicones). Evaluation of the economic availability of silicones within each dosage form has made it possible to state that the lowest DDD cost of silicone drugs corresponded to the form of chewable tablets, the highest - to oral suspension.

Keywords: simethicone, pharmaceutical market, availability of medicinal products

Introduction

In recent years, the scientific press and congresses have widely covered the problem of colic in children [1-3]. In our opinion, this is primarily due to the fact that the number of children with this condition has increased significantly [4], and the available therapies do not always fully satisfy not only doctors but also parents. According to various authors, baby colic occurs in 20-48% of children in the first year of life.

When considering a baby colic correction program, the mother's diet should be the first thing to pay attention to. According to modern notions, severe colic is most often associated with food allergy to cow's milk protein, so if the baby is breastfed, it is necessary to completely exclude all dairy products, and sometimes beef and veal from the mother's diet.

The safest and most effective way to treat colic in children is to use defoamers (simethicone drugs). They are modern effective and safe means against baby colic. The mechanism of action is based on the weakening of the surface tension of gas bubbles in the digestive tract, which leads to their breaking up and subsequent excretion of gas from the body [5, 6].

Simethicone drugs are inert, are not absorbed from the gastrointestinal tract, and do not affect gastric secretion and absorption of nutrients. After oral administration, simethicone is excreted unchanged in the feces [7-9]. There is no addiction to it. Simethicone represents one of the final preparations for oral application, which eliminates the gases from the gastrointestinal tract in patients for IVU. It is an antiflatulent that reduces gases-caused symptoms of the gastrointestinal tract. The drug is in the form of soft gelatin capsules taken orally, at any time and any place, because the capsules can be easily swallowed without water. Each capsule contains 40 mg of active ingredients – simethicone [10]. Simethicone works by changing the surface tension of gas bubbles trapped in the food and mucous alimentary canals. First, it reduces the surface tension of gas bubbles and then degrades it. Liberated gases can be easily absorbed through the intestinal wall or eliminated by enterokinesis. It should be emphasized that simethicone acts purely physically, does not enter the circulation, and does not participate in chemical reactions [11-15].

The aim of the work is to analyze the Ukrainian market of drugs for the treatment of gastrointestinal disorders from the group of ATC A03A X13 "Silicones".

Materials and Methods

The analysis of the market of drugs from the group of "silicones" has been carried out. The study used data from the State Register of Medicines, articles in scientific journals, price lists, and information from the official websites of manufacturers and distributors of medicinal cosmetics, as well as the range of pharmacies in Kharkov. Methods of comparison, as well as logical, mathematical, and statistical methods were used [16, 17].

Results and Discussion

According to the ATC classification of drugs (Anatomical Therapeutic Chemical (ATC) classification system), the means used to treat functional disorders of the gastrointestinal tract (GIT) include silicones, ATC code, A03A X13 (A03A X - Other preparations for use in functional gastrointestinal disorders).

State form of medicines, current issue No. 11, approved by the order of the Ministry of Health of Ukraine No. 892 "On approval of the eleventh issue of the State Form of Medicines and ensuring its availability" dated April 18, 2019 [18], which contains recommendations for the rational choice and use of drugs, taking into account the effectiveness, safety and economic feasibility of their use in the pharmacotherapy of diseases and conditions in section 3 "Gastroenterology"; there are 2 silicone preparations (COLIGAS-ZDOROVYE, oral drops and chewable tablets), which confirms the importance of silicones in the treatment of gastrointestinal diseases. Simethicone drugs (silicones) are also included in the standards of medical care, in particular in the sections "Gastroenterology" and "Pediatric Gastroenterology". The need for the use of silicones in the treatment of common diseases and conditions determines the relevance of the market analysis of this group of drugs.

The study has analyzed the pharmaceutical market of silicone drugs (international non-proprietary name, INN - silicone), registered in Ukraine, as well as offers of medicinal products of silicones, presented on the wholesale domestic market by distributors.

It has been established that as of 01.02.2020, 10 trade names of drugs under the INN "Silicones", or 15 drugs considering dosage forms (DF), as well as 5 trade names of drug substances under the INN "Silicones" were registered in Ukraine, which may indicate sufficient satisfaction of the pharmaceutical market with drugs of this group (Table 1).

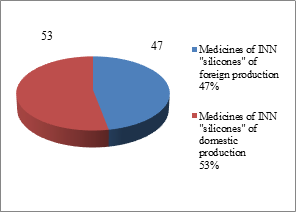

Structural analysis of registered drugs by INN "Silicones" has shown that 8 drugs (or 53%), including DFs, are represented by domestic manufacturers, and 7 drugs (47%), respectively, by foreign companies. Thus, in the pharmaceutical market of Ukraine, there is an insignificant dominance of domestic silicone drugs, which is a positive trend (Figure 1).

|

Table 1. Cost characteristics of silicone preparations on the domestic pharmaceutical market (March 2020) |

||||||

|

Preparation |

Manufacturer |

Dosage Form |

Purchase price, UAH |

The average cost of DDD (0.5 g), UAH |

||

|

min. |

max |

average |

||||

|

LIQUID DOSAGE FORMS: |

||||||

|

Oral Drops: |

||||||

|

CUPLATON |

Orion Corporation (Finland) |

oral drops. 300 mg/ml, 30 ml, № 1 |

211,4 |

255,19 |

233,30 |

12,96 |

|

ESPUMISAN® Baby |

BERLIN-CHEMIE AG, Germany |

oral drops, emulsion 100 mg/ml, 50 ml, № 1 |

187,45 |

187,45 |

187,45 |

18,75 |

|

SIMETICONE |

Pharmaceutical firm «Verteks», Ukraine |

oral drops. 40 mg/ml, 30 ml, № 1 |

58 |

64,48 |

61,24 |

25,52 |

|

COLIGAS-ZDOROVYE |

Pharmaceutical company «Zdorovye», Ukraine |

oral drops., emulsion 40 mg/ml, 30 ml, № 1 |

90,61 |

97,27 |

93,94 |

39,14 |

|

ESPUMISAN L |

BERLIN-CHEMIE AG, Germany |

oral drops., emulsion 40 mg/ml, 30 ml, № 1 |

93,91 |

105,18 |

99,55 |

41,48 |

|

ESPUMISAN® Baby |

BERLIN-CHEMIE AG, Germany |

oral drops., emulsion 100 mg/ml, 30 ml, № 1 |

124,96 |

124,96 |

124,96 |

52,07 |

|

Average Value: |

26,44 |

|||||

|

Oral Suspension: |

||||||

|

COLLICKID |

Kusum Pharm, Ukraine |

oral suspension 40 mg/ml, 30 ml, № 1 |

99,7 |

113,7 |

106,70 |

26,68 |

|

INFACOL |

Forest Laboratories Uk Ltd, England |

oral suspension 40 mg/ml, 50 ml, № 1 |

136,9 |

152,57 |

144,74 |

36,18 |

|

Average Value: |

31,43 |

|||||

|

SOLID DOSAGE FORMS: |

||||||

|

Soft Capsules: |

||||||

|

COLIGAS-ZDOROVYE |

Pharmaceutical company «Zdorovye», Ukraine |

capsules 125 mg, № 30 |

55,04 |

63,71 |

59,38 |

7,92 |

|

AFLETIN |

Kyiv Vitamin Plant, Ukraine |

capsules 125 mg, № 20 |

36,73 |

44,57 |

40,65 |

8,13 |

|

MOTILIGAS |

McNeil Products Ltd, England |

capsules 120 mg, № 20 |

58,03 |

67,34 |

62,69 |

13,06 |

|

ESPUMISAN |

BERLIN-CHEMIE AG, Germany |

capsules 40 mg, № 25 |

70,31 |

79,18 |

74,75 |

37,37 |

|

ESPUMISAN |

BERLIN-CHEMIE AG, Germany |

capsules 40 mg, № 50 |

122,67 |

140,51 |

131,59 |

32,90 |

|

Average Value: |

22,86 |

|||||

|

Chewable Tablets: |

||||||

|

COLIGAS-ZDOROVYE |

Pharmaceutical company «Zdorovye», Ukraine |

tablets chewing on 125 mg, № 14 |

29,89 |

36,47 |

33,18 |

9,48 |

|

COLIGAS-ZDOROVYE |

Pharmaceutical company «Zdorovye», Ukraine |

tablets chewing on 125 mg, № 7 |

16,05 |

18,26 |

17,16 |

9,80 |

|

Average Value: |

9,64 |

|||||

|

Coated Tablets: |

||||||

|

COLIGAS-ZDOROVYE |

Pharmaceutical company «Zdorovye», Ukraine |

coated tablets 125 mg, №14 |

31,66 |

37,09 |

34,38 |

9,82 |

|

COLLICKID |

Kusum Pharm, Ukraine |

coated tablets 125 mg, № 30 |

66,17 |

82,91 |

74,54 |

9,94 |

|

SIMETICONE |

Pharmaceutical firm «Verteks», Ukraine |

coated tablets 125 mg, № 14 |

42,56 |

46,61 |

44,59 |

12,74 |

|

Average Value: |

10,83 |

|||||

|

Average Value per Group: |

20,24 |

|||||

Among foreign companies producing silicones, the largest number of registered drugs, including DF, is presented by the company Berlin Chemie" (Germany) with 3 names, followed by "Catalent Germany Eberbach GmbH" (Germany) with 2 names. One medicinal product is registered by companies " Pharmaceuticals NV" (Belgium) and «Orion Corporation» (Finland).

Figure 1. The share of drugs registered in Ukraine under the INN "Silicones" on the indicator "domestic/foreign" (as of 01.02.2020)

Thus, the largest share among the countries, importing drugs under INN "Silicones" to Ukraine belongs to drugs of German production (5 names including DF), with more than 70% of the total number of registered silicones of foreign production. Silicones made in Belgium, Finland, and France are also available on the domestic market. In total, as of 01.02.2020, 4 foreign companies have registered 7 drugs (including DF) of INN "silicones" on the domestic pharmaceutical market.

Domestic manufacturers that have registered silicone preparations in the domestic pharmaceutical market are represented by four companies: "Kusum Pharm" (Ukraine, Sumy), Pharmaceutical company "Verteks" (Ukraine, Kharkiv), Pharmaceutical company "Zdorovye" (Ukraine, Kharkiv), and Kyiv Vitamin Plant (Ukraine, Kyiv). Each company has presented one drug by trade name; but, the largest share in the number of drugs, taking into account the DF corresponds to the Pharmaceutical company "Zdorovye" (almost 40% of the total number of domestic silicones, including DF). Kyiv Vitamin Plant has introduced 1 product to the market, and the pharmaceutical company "Verteks" and "Kusum Pharm" has introduced 2 products taking into account DF.

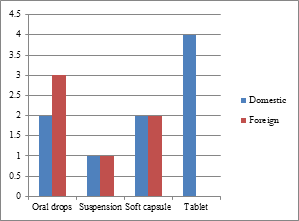

The next stage of the study was the analysis of silicones registered on the domestic pharmaceutical market as of February 2020, by dosage forms. It was established at the time of the study, registered drugs for INN "silicones" are liquid (53% of the total) and solid (47%) dosage forms. Liquid dosage forms are represented mainly by oral drops (5 drugs, 3 of which are foreign-made), as well as suspension (2 drugs, one domestic and one of foreign production). Solid DF of silicones registered in Ukraine is represented by tablets (4 medicines of domestic production) and soft capsules (2 names of domestic and foreign production) (Figure 2). It should be noted that foreign silicone drugs are represented mainly by oral drops. At the same time, tablets are offered only by domestic manufacturers.

Figure 2. Distribution of medicinal INN "silicones" registered by dosage form in Ukraine (as of 01.02.2020)

Thus, the study of the domestic market of registered drugs under the ATC code A03A X13 silicones allows us to conclude that there is a sufficient range of drugs in this group, both foreign and domestic production, which, of course, is a positive trend. It can be expected that the presence of four different dosage forms contributes to the proper quality assurance of silicone therapy.

To analyze the physical availability of silicone drugs in Ukraine, we have analyzed the wholesale market of drugs of this group, namely the offers of distributors. The online database of the Morion analytical search system has been used for the analysis, in particular, the section "Wholesale Offers" as of February 2020 [19].

It was found that in the proposals of distributors more than 90% of drugs from the study group were presented (14 out of 15 drugs). There was only one medicine absent - ESPUMISAN® Baby («Berlin Chemie», Germany). At the same time, at the time of compilation of the results of the study - 06.03.2020, this drug was present in the offers of distributors. Therefore, it can be stated about 100% presence on the wholesale pharmaceutical market of all drugs registered in Ukraine under INN "Silicones". In further calculations, the data as of March 6, 2020, were taken into account.

The analysis of the wholesale market of drugs should be carried out taking into account the dosage forms and the number of doses in the package. Thus, it has been established that in the domestic wholesale pharmaceutical market 10 trade names of drugs from the pharmacological group "silicones" are represented by 18 preparations (Table 2).

|

Table 2. Registered in Ukraine medicinal products and substances under the ATC code A03A X13 "Silicones" (as of 01.02.2020) |

||||

|

Medicines under the ATC code A03A X13 "Silicones" |

||||

|

Name/dosage form |

The composition of the active substances |

Manufacturer |

Applicant |

|

|

1 |

ESPUMISAN® L |

1 mL of oral drops, emulsion (25 drops) contains simethicone 40 mg |

BERLIN-CHEMIE AG, Germany |

BERLIN-CHEMIE AG, Germany |

|

2 |

ESPUMISAN® |

1 soft capsule contains simethicone 40 mg |

Catalent Germany Eberbach GmbH, Germany |

BERLIN-CHEMIE AG, Germany |

|

3 |

COLIKID ® |

1 tablet contains simethicone 125 mg |

KUSUM PHARM LLC., Ukraine |

KUSUM PHARM LLC., Ukraine |

|

4 |

COLIKID ® |

1 ml of suspension contains simethicone emulsion equivalent to simethicone 40 mg |

KUSUM PHARM LLC., Ukraine |

KUSUM PHARM LLC., Ukraine |

|

5 |

ESPUMIZAN® BABY |

1 mL of oral drops, emulsion, contains simethicone 100 mg |

BERLIN-CHEMIE AG, Germany |

BERLIN-CHEMIE AG, Germany |

|

6 |

SIMETICON |

1 tablet contains simethicone 125 mg |

"Pharmaceutical firm "Verteks" LLC, Ukraine |

"Pharmaceutical firm "Verteks" LLC, Ukraine |

|

7 |

SIMETICON |

1 ml (27 drops) of the drug contains simethicone 40 mg |

"Pharmaceutical firm "Verteks" LLC, Ukraine |

"Pharmaceutical firm "Verteks" LLC, Ukraine |

|

8 |

COLLIGAS-ZDOROVYA |

1 tablet contains simethicone, in terms of polydimethylsiloxane 125 mg |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

9 |

MOTILIGAS |

1 soft capsule contains simethicone 120 mg |

Catalent France Beinheim SA, France |

McNeill Products Limited, United Kingdom |

|

10 |

COLIGAS-ZDOROVYA |

1 capsule contains simethicone 125 mg; |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

11 |

AFLETIN |

1 capsule contains simethicone 125 mg |

JSC "KYIV VITAMIN PLANT", Ukraine |

JSC "KYIV VITAMIN PLANT", Ukraine |

|

12 |

COLIGAS-ZDOROVYA |

1 tablet contains simethicone, in terms of polydimethylsiloxane 125 mg |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

13 |

COLIGAS-ZDOROVYA |

1 ml (27 drops) of the drug contains simethicone, in terms of polydimethylsiloxane 40 mg |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

14 |

INFACOL |

1 ml of suspension contains 40 mg of simethicone |

Purna Pharmaceuticals NV, Belgium |

Teva Ukraine LLC, Ukraine |

|

15 |

KUPLATON |

1 mL (35 drops) contains 300 mg of dimethicone |

Orion Corporation, Finland |

Orion Corporation, Finland |

|

Substances under the ATC code A03A X13 "silicones" |

||||

|

1 |

SIMETICON |

simethicone contains not less than 90.5% and not more than 99.0% of polydimethylsiloxane and not less than 4.0% and not more than 7.0% of silicon dioxide liquid (substance) in polyethylene drums for pharmaceutical use |

RioCare India Private Limited, India |

KUSUM PHARM LLC., Ukraine |

|

2 |

SIMETICON |

simethicone contains not less than 90.5% and not more than 99.0% of polydimethylsiloxane and not less than 4.0% and not more than 7.0% of silicon dioxide liquid (substance) in polyethylene drums for pharmaceutical use |

RioCare India Private Limited, India |

KUSUM PHARM LLC., Ukraine |

|

3 |

BOBOTIC |

1 ml of emulsion contains simethicone (dimethicone activated by silicon dioxide in the form of 30% emulsion) 66.66 mg; |

MEDANA PHARMA Joint Stock Company, Poland |

MEDANA PHARMA Joint Stock Company, Poland |

|

4 |

ESPICOL BABY |

1 ml of drops contains emulsions of simethicone equivalent to simethicone 40 mg; |

Indoco Remedies Limited, India |

Euro Lifecare Private Limited, India |

|

5 |

COLIGAS-ZDOROVYA |

1 tablet contains simethicone 125 mg: 4000 tablets in a plastic bag in a container |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

6 |

COLIGAS-ZDOROVYA |

1 ml (27 drops) of the drug contains simethicone 40 mg: 10 liters or 50 liters in metal KEG barrels |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

|

7 |

SIMETICON |

poly (dimethylsiloxane) from 90.5% to 99.0% (simethicone) liquid (substance) in polyethylene drums for pharmaceutical use |

RioCare India Private Limited, India |

"Pharmaceutical company "ZDOROVYA"LLC, Ukraine |

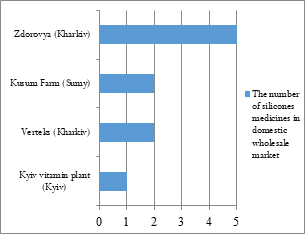

Structural analysis of the sample of drugs under study shows that the majority of silicones in the wholesale market are of domestic production - 10 out of 18, or more than 55% of the sample. Figure 3 presents the distribution of domestic silicone manufacturers by the number of drugs represented in the wholesale pharmaceutical market of Ukraine as of March 2020.

Figure 3. Distribution of domestic silicone manufacturers by the number of drugs represented on the wholesale pharmaceutical market of Ukraine as of March 2020

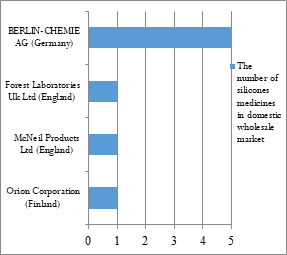

It was found that the largest number of silicone products in the domestic wholesale market corresponded to Pharmaceutical Company "Zdorovya" )50% of all drugs of domestic production(, 20% of the market was occupied by drugs of "Kusum Pharm" and Pharmaceutical firm «Verteks», and 10% by medicines of Kyiv Vitamin Plant. Among foreign manufacturers, the largest share of medicines in the domestic wholesale silicone market was occupied by the company "Berlin Chemie" (Germany) (more than 60%); 12.5% of imported drugs were for other companies (Figure 4).

In general, the leaders of foreign and domestic segments (Berlin Chemie and Pharmaceutical company "Zdorovye" respectively) in the proposition of domestic and imported silicones in the wholesale pharmaceutical market occupied the same market share of silicones - slightly less than 30%. That is, it is desirable to increase the number of domestic drugs, which will facilitate the availability of silicones for the population.

Figure 4. Distribution of foreign producers of silicones by the number of drugs (including DF) in the wholesale pharmaceutical market of Ukraine (March 2020)

Given the feasibility of the development of domestic drugs of the "silicones" group, it may be interesting to analyze the dosage forms of drugs of this group, which are presented on the wholesale market as of March 2020.

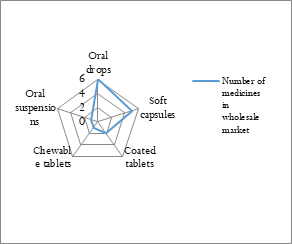

Figure 5. The results of the analysis of the domestic wholesale market of silicones by dosage form (March 2020).

The results of the analysis of the wholesale market of silicones by dosage form are presented in Figure 5. It was found that in general preparations of silicones are represented by six dosage forms, including liquid - oral drops and oral suspension, hard-soft capsules, chewable tablets, and coated tablets. The number of hard and liquid dosage forms was the same (8 names). At the same time, the largest number of silicones is presented in the form of oral drops (33% of the total number of silicones in the domestic wholesale market), followed by soft capsules (28%), and coated tablets (17%).

One of the important indicators of the affordability of drugs for the patient and the health care system as a whole is the price. Therefore, the next stage of the study was the analysis of drug prices for INN "Silicone", which are presented on the wholesale market as of March 2020. The data were obtained from the online press lists of the weekly "Pharmacy" by the analytical company "Morion".

Table 1 shows the minimum and maximum purchase prices for drugs offered by distributors for the study period. To properly compare the cost of medicines, we calculated the average purchase price. However, differences in the number of units of the active substance in each package of drugs do not allow for an equilibrium comparison of prices, so the next step was to determine the cost of the daily defined dose (DDD) - DDD of A03AX13, Silicones that is 0.5 g [https://www.whocc.no/atc_ddd_index/?code=A03AX1].

We have ranked medicines within each of the dosage forms; it was found that the average purchase price of the defined daily dose is the lowest for silicones in the form of chewable tablets - 9.64 UAH. This value may be due to the fact that in this DF is presented only by domestic manufacturers, which significantly increases its economic affordability. The most expensive of all drugs were oral suspension, with the average purchase price of DDD - 31.43 UAH.

The performed structural analysis of the average purchase price of the DDD within each dosage form can be used in the future by manufacturers of new silicone products to form a competitive price in this segment of the domestic pharmaceutical market.

Conclusion

In general, the results of the analysis of the domestic pharmaceutical market of medicines for INN "Silicone" have identified a sufficient number of registered drugs, among which insignificantly dominate domestically produced drugs. It was established that 100% of the registered medicines of the silicone group are represented in the wholesale market. Structural analysis of dosage forms showed a significant dominance of silicones in the form of oral drops (33% among 5 DF of silicones). Evaluation of the economic availability of silicones within each DF has allowed us to state that the lowest cost of silicones DDD corresponded to the chewable tablets, and the highest cost to oral suspension.

Conflict of interest

All authors declare that there is no conflict of interest among the authors.

References

- Faddladdeen K A. Comparative Liver Histopathological and Histochemical Studies in Hydatid Cyst Disease with Mean Optical Transparency. Pharmacophores. 2019; 10(2): 51-62.

- Saraswat N, Sachan N, Chandra P. A Detailed Review on the rarely found Himalayan herb Selinum vaginatum: Its Active constituents, pharmacological uses, traditional and potential benefits. Pharmacophores. 2020; 11(2): 40-5

- Alzanitan A I, Alnawdal A N, Alabood M A, Alelwan M K, Al Sameen R M, Alhawiti F S, Hassan A M, Mohammad S, Alajmi N S, Alsaeed10 M M. Evaluation of recent Updates regarding Screening and Management of Colorectal Carcinoma. Arch. Pharma. Pract. 2020; 1: 52-55.

- Addas M J, Alshammari R M, Alokayli A M, Bedaiwi A K, Ghabban A M, Alasiri A M, AlKishan K M, Alhumairi N A, Saleh R K, Saber A H, Alruwaili A N. Evaluation of Acalculous Cholecystitis, Diagnosis, and Management. Arch. Pharma. Pract. 2019; 1: 17-20.

- AHFS. Drug Information - Simethicone. - Bethesda: American Society of Health-System Pharmacists. Electronic version. 2007.

- Althaus P, Mesnil M. Piptal® gouttes: produit de remplacement. Schweiz Apoth Z 1991; 129 (2): 43-4.

- Dollery C, ed. Therapeutic Drugs. Simethicone. 2nd ed. Edinburgh: Churchill Livingstone, 1999: 35-

- Leung A, Lemau J. Infantile colic: a review. J R Soc Health. 2004; 124 (4): 162-80.

- Martindale. The cjmplete drug reference. Simethicone. London: Pharmaceutical Press, Electronic Version, 2008.

- Rade R. Babić, Bratislav Bašić, Kristina Govedarović, Boris Đinđić, Gordana Stanković Babić and Svetlana Marković Perić. Excretory urography in patients prepared by simethicon (Espumisan®). Acta Medica Medianae/ 2011; 50 (1): 38-43.

- Sudduth RH, DeAngelis S, Sherman KE, McNally PR. The effectiveness of simethicone in improving visibility during colonoscopy when given with a sodium phosphate solution: a double-bind randomized study. Gastrointest Endosc. 1995; 42 (5): 413-5.

- Albert J, Göbel CM, Lesske J, Lotterer E, Nietsch H, Fleig WE. Simethicone for small bowel preparation for capsule endoscopy: a systematic, singleblinded, controlled study. Gastrointest Endosc. 2004; 59 (4): 487-91.

- Holtmann G, Gschossmann J, Mayr P, Talley NJ. A randomized placebo-controlled trial of simethicone and cisapride for the treatment of patients with functional dyspepsia. Aliment Pharmacol Ther. 2002; 16 (9):1641-8.

- Bertoni G, Gumina C, Conigliaro R, Ricci E, Staffetti J, Mortilla MG, Pacchione D. Randomized placebocontrolled trial of oral liquid simethicone prior to upper gastrointestinal endoscopy. Endoscopy. 1992; 24 (4): 268-70.

- Abu-Yousef MM, El-Zein Y. Improved US visualization of the pancreatic tail with simethicone, water, and patient rotation. Radiology. 2000; 217 (3): 780-5.

- Compendium – on-line drugs. Reference drugs № 1 in Ukraine. [updated 2019 March 01; cited 2019 March 06]. Available from: http://compendium.com.ua.

- reestr likarskih zasobiv Ukrainy D. State register of medicinal products of Ukraine.

- Ministry Of Health Of Ukraine Department of Pharmaceutical Activities State Expert Center of the Ministry of Health of Ukraine "State Registry of Medicines of Ukraine" Information Fund. . [updated 2019 March 03; cited 2019 March 08]. Available at: http://www.drlz.com.ua/ibp/ddsite.nsf/all/shlz1?opendocument&stype=0D8CF52BF0FF0E6BC22580CA00452578.

- Medicines market research system “Farmstandart” by company “Morion”. Available from: http://www.pharmstandart.com.ua

Contact SPER Publications

SPER Publications and

Solutions Pvt. Ltd.

HD - 236,

Near The Shri Ram Millenium School,

Sector 135,

Noida-Greater Noida Expressway,

Noida-201301 [Delhi-NCR] India